Retirement Planning

The Trudeau Group

At The Trudeau Group, we are here to help you enjoy a confident, carefree retirement—one supported by a steady monthly income and a clear, reliable financial plan.

Our mission is to empower you to live your passions and pursue your dreams, now and into retirement. Through straightforward strategies and clear communication, we guide you toward your goals—helping you reach them sooner and with greater peace of mind by creating a personalized, comfortable plan that supports the lifestyle you envision now and in the future.

Effective financial planning starts with the right questions. We take the time to understand your goals, needs, and priorities, then craft a tailored strategy designed to turn those goals into reality. We’re committed to earning your trust by delivering a plan that provides stability—and a reliable monthly income—for the rest of your life. At The Trudeau Group, we build lasting relationships by putting our clients first. Our goal is to help you feel secure, protect your legacy, and confidently pursue the retirement you’ve always dreamed of. Our team is committed to helping you build a strong, tax-efficient financial plan that includes Social Security optimization, asset protection, and proactive strategies to hedge against rising healthcare costs and inflation.

With personalized guidance and a focus on long-term stability, we help you confidently pursue the life you’ve envisioned—knowing your legacy is protected and your dreams are within reach.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

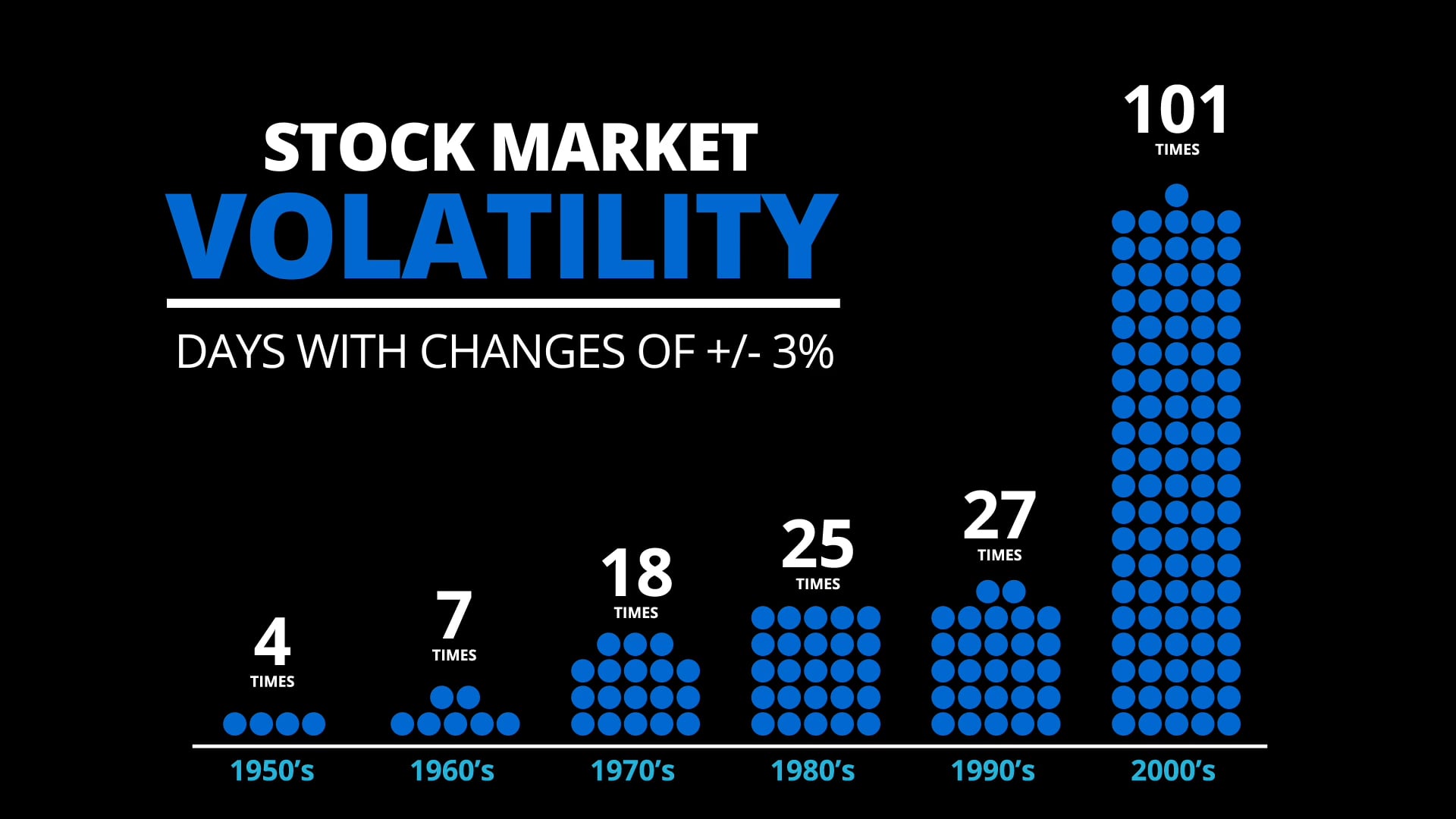

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Founder

Thomas Trudeau

CEO & Founder

With over 32 years of experience in financial services and insurance, Thomas Trudeau has

dedicated his career to helping individuals and business owners create lasting financial security.

His mission has always been clear: to protect his clients’ lifestyles and help them avoid the

financial pitfalls he’s seen—and personally experienced—throughout his life.

Thomas’s success stems from his deep industry knowledge, sharp communication skills, and

genuine ability to connect with people. As a veteran and lifelong learner, he blends discipline,

compassion, and insight into every client relationship. For Thomas, financial planning isn’t just about numbers—it’s about giving people the freedom to live a carefree, fulfilling life.

A proud Midwesterner, Thomas grew up between the football field and his family’s lake home,

where he developed a lifelong passion for the outdoors and fishing. After graduating as an officer

from the prestigious Cretin Military Academy in St. Paul, Minnesota, he worked his way through

college and earned a Bachelor of Science in Psychology with a minor in Business from Arizona

State University. This background continues to shape his client-first approach, helping him

understand not just financial needs—but personal goals and motivations.

Over the course of his career, Thomas has partnered with more than 100 insurance and financial companies, building an unmatched depth of expertise across both the corporate and private

sectors. As an entrepreneur and advisor, he’s known for cultivating long-term, transparent

relationships grounded in loyalty and trust.

Today, Thomas leads The Trudeau Group with unwavering values, ethical leadership, and a

passion for helping others build the future they deserve.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in January–March 2026

- There are no events scheduled during these dates.

Our Downloads

Stress Free Retirement

This book has done for the annuity marketplace what Tax-Free Retirement did for life insurance. The response has been overwhelming. Nearly every person who reads this book wants to schedule a follow up with the person who gave it to them to discuss how this product can enhance their retirement. Don’t miss out! This is the book you have been waiting for. A book that could revolutionize your retirement years.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.